Why I’m Allocating 10% of My Portfolio to Uranium

As the AI revolution kicks off, we’ll need nuclear energy to fuel it.

tl;dr

Artificial Intelligence (AI) computing requires substantial energy, increasing the urgency for sustainable, scalable, and modular energy solutions.

Major tech companies are actively adopting and investing in new ways to tap into nuclear power sources.

The spot price for Uranium doubled over the past year due to a supply-demand imbalance, as current uranium supplies struggle to meet the demand from nuclear reactors.

I argue that the current market presents a good entry point for diversifying into the uranium sector. Macroeconomic tailwinds could suggest a strong outperformance over the next decade at the cost of short-term volatility. I outline my thought process for choosing URA 0.00%↑ as a vehicle to do so.

Table of Contents

Conversations & Ideas Coming Together

A few weeks ago, I discussed data center capacity planning with a friend who works for a major tech company. While we initially focused on the scarcity of GPUs—a common topic nowadays—what surprised me was learning how significantly energy consumption factors into the planning process.

Apparently, most large data centers contain vast arrays of unused racks simply because there isn't enough energy available to power everything. My own experience in capacity planning has primarily involved estimating resources like usage, cost, bandwidth, storage, memory, and CPU. However, I've never had to consider the challenges of acquiring hardware, installation, heat dissipation, or energy consumption. It was fascinating to realize that energy is often the critical limiting factor.

This insight lingered in my mind, but I didn't take any action until watching the Berkshire Hathaway annual shareholders meeting last Saturday. During the presentation, Buffett highlighted their operating earnings, and a significant increase in the energy line item piqued my interest:

This connection brought to mind a tweet from @jessefelder about recent rises in commodity prices. Although we are not at the cycle's nadir, I would argue that phases (2), (3), and (4) are just beginning, and (1) is too sensitive of a topic to mention here.

Related Reading & Listening

Over the past few years, I've noticed prominent figures like Satya Nadella, CEO of Microsoft, and Sam Altman, CEO of OpenAI, frequently discuss energy issues. This piqued my curiosity, so I had to spend part of my weekend researching this. I googled something along the lines of “nuclear power plants and data centers”, and discovered that Amazon recently spent $650M to strategically expand into a data center located adjacent to a nuclear power plant.

I dove deeper…

I read an article from SeekingAlpha titled “URA ETF: Profit from AI and Bitocin through Uranium”, published on 03/18/2024. Here are some of the key takeaways:

AI and Crypto could push global energy consumption to double by 2026 to 1,000 TwH.

Daily, Hugging Face consumes 433 MWh to train its models—enough to power 40 average US homes for a year.

An Nvidia H100 GPU uses twice the energy of an Intel or AMD CPU.

These points led me to consider the potential energy consumption of Nvidia’s upcoming Blackwell GPUs, which are yet to be featured in their Energy Efficiency Calculator. At the 28-minute mark of Jensen Huang's latest keynote, the focus was on FLOPS and bandwidth, underscoring that the issue of energy efficiency is still emerging.

Another article, “URA: Is it Time To Buy?”, offered insights into the uranium market. Key takeaways include:

Kazatomprom and Cameco supply about 40% and 20% of global uranium, respectively.

Nuclear power reactors generate about 10% of the world's electricity, with Asia leading significantly.

It can take 10-15 years for new mines to become operational, and many smaller miners are yet to turn a profit.

Additionally, I listened to an episode of the Commodity Culture podcast titled "There's Never Been a Uranium Bull Market Like This in History: Chris Timmins." Key points from the discussion:

Experts express uncertainty about the next 1-2 years, making it challenging to predict the success of new mining ventures.

The current demand for uranium far exceeds supply, contributing to its recent price surge.

Rising energy requirements, particularly driven by AI, are expected to further accelerate demand.

We've undoubtedly moved past the "bear" phase and the "bottom" of the uranium market, yet we remain distant from a euphoric peak. It was nice to hear an expert in the field provide a grounded perspective, carefully outlining potential risks while maintaining an optimistic outlook without any pretense of "we’re geniuses for making this investment."

Small Modular Reactors & Microsoft

Small Modular Reactors (SMRs) are among the most intriguing learnings I made during my research. SMRs are compact, self-contained nuclear reactors capable of powering localized grids. What’s an example of a power-hungry localized value-creating area? You’re right, a data center.

Here’s a quick breakdown of SMRs from a very informative article:

✅ Reliable: SMRs deliver constant, reliable, and predictable energy throughout the year, unlike intermittent sources like wind and solar.

✅ Green: They are a carbon-free alternative to traditional fossil fuels.

✅ Compact: SMRs are small and modular, able to operate independently from larger grids. This minimizes their footprint and reduces maintenance costs.

❌ Downsides: Challenges include public perception, regulatory hurdles, and substantial initial investments. However, I believe these issues are manageable with time, effort, and capital..

Microsoft is at the forefront of this technology. They’re potentially positioning themselves to offer "SMR on Demand"—akin to how they expanded their investment from internal data centers to external cloud services.

They are seeking (or may have already hired) a principal program manager for nuclear technology.

Microsoft’s cloud division is exploring the deployment of small modular microreactors. I find the allure of a compact, self-contained energy solution quite appealing.

While slightly off-topic, I must mention Helion, a new startup focused on fusion power. Microsoft plans to purchase energy from Helion by 2028. Fusion uses a hydrogen isotope, differing from the uranium-based approach of SMRs, but it underscores the growing importance of energy solutions. Helion is backed by Sam Altman, and they’re hiring a Senior AI Application Engineer. It’ll be fun once they build their own AI assistant, financed in part by Sam’s investment, powered by their own reactor, using GPT(X) behind the scenes, which again is lead by Sam, while also selling some of the energy from their reactors to Microsoft, which invested in OpenAI, which, in case you’ve forgotten, is lead by Sam 🙃

Investment & Exposure Options

At this point, having solidified my uranium and energy investment thesis, I needed to choose an appropriate investment vehicle. Given my limited time and lack of interest in identifying individual miners or dealing with commodity futures, I opted to explore ETF options.

Here’s a breakdown of the top 3 Uranium ETFs: URA, URNM and NLR.

URA:

Div yield: 5.77% with a 0.69% expense ratio

Net Assets: $3.31B

Top holdings: Primarily large miners & some spots (CCO, U-U, NXE, PDN, UEC)

Opinion: I like how high their dividend yield is, get comfort from the size of their net assets, and appreciate the value they’ve settle on for their expense ratio 😉. However, I would prefer less concentration on CCO and greater diversification into KAP.

Div yield: 3.25% with a 0.75% expense ratio

Net Assets: $1.75B

Top holdings: Primarily large miners & some spots (CCO, KAP, U-U, 1164 HK, PDN)

Opinion: Despite a lower dividend yield and a higher expense ratio compared to URA, URNM offers similar diversification. The allocation to KAP is appreciated, but it's not compelling enough for me to choose this ETF over URA.

NLR:

Div yield: 4.05% with a 0.61% expense ratio

Net Assets: $161.4M

Top holdings: Primarily large miners & some spots (PEG, CEG, CCO, PCG)

Opinion: The relatively low net assets value is a deterrent, considering the alternatives.

In short, URA seems good enough.

Risks

This investment is guided more by a thesis than by traditional fundamentals, making it challenging to offer precise ROI expectations, timelines, or figures. However, the major risks include:

Timelines: The next two years are unpredictable. I don't try to time the market, so I consider the present as good a time as any to invest.

Supply and Demand: Predicting this is difficult. My thesis is driven by changes in the energy sector on the 5-10 year timeframe, but I anticipate the market to price things in sooner.

Legislative Risks: A significant threat is the possibility of governments completely banning nuclear reactors, which could render this investment worthless.

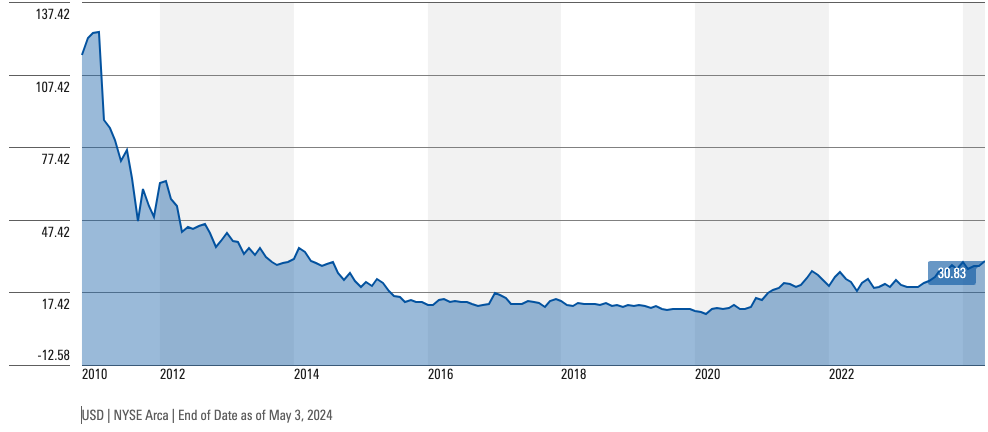

Downside - I see a 50% drawdown as the worst case scenario based solely on what the charts over the last 10 years look like.

Market Stagnation: There's the risk that the investment could remain flat for years before anything changes, which comes at an opportunity cost to other investments.

Position Sizing, Entry & Exit Plan

Here’s my tailored approach to investing, which diverges from traditional dollar-cost averaging strategies but helps me maintain peace of mind by passing the “sleep well at night” test.

I estimate my liquid post-tax* net worth, decide on a total % allocation depending on much confidence I have in the thesis. In this case, I have settled on 10%, and will do the following:

Liquid Net Worth Assessment: I start by estimating my liquid post-tax net worth** and decide on a total percentage allocation based on my confidence in the thesis. For this uranium investment, I've chosen a 10% allocation.

Entry Strategy::

Find a reasonable entry poin: URA 0.00%↑ is at $30.83 as I’m writing this. This isn’t cheap, but doesn’t seem obscenely expensive given their portfolio is structure (refer to the image below).

Entry #1: Invest 60% of my total allocation when the markets open tomorrow.

Entry #2: Should the price drop 20% to $24.7, I will invest an additional 20% of my 10% allocation.

Entry #3: If the price falls another 20% to $19.7, I'll invest the remaining 20% of my allocation and then halt further investments.

Exit Strategy:

Exit #1: Once the price doubles to $61.7 from my entry point, I'll sell 25% of my holdings.

Exit #2: When the price triples to $92.5, I will sell enough to recoup my original investment, and riding the rest.

Exit #3: This is too far out to predict or plan for. I anticipate my circumstances may change significantly, so I prefer to keep this stage flexible.

** This estimation assumes I would liquidate everything. It also does not take into account any assets related to my current day-to-day work. I believe the upside potential is unparalleled when you have direct impact on the direction and evolution of a product. Investing is a hobby for me, from which I hope to learn and profit. I’ll be satisfied if I match the market after putting all this effort into research.

Personal Thoughts & Takeaways

Over the past few years, I've observed considerable distaste towards the crypto industry due to its energy consumption, yet this criticism doesn't seem to extend to the AI industry. There are some blog posts that compare and predict AI and Crypto electricity demand (e.g., The Verge), and I'm really curious to see how this will unfold.

My side-quest into Small Modular Reactors (SMRs) really excited me. It's a business that will require significant capital investment and strong government connections, but I genuinely believe it will result in a win-win-win scenario for everyone.

In conclusion, investing in Uranium is a wager on AI, crypto, commodities, continued inflation, and a clean, sustainable future. I don’t claim to call market bottoms or time the markets, but I invest when I see opportunity.

Disclaimer: I am long URA and none of this is financial advice. However, if you are seeking investment advice, I think it’s highly unlikely (though possible) that a randomly assigned advisor at the local branch of your bank is the right person for you. Warren Buffet’s shareholder letters are a much better place to start.

This is an awesome read! Thanks for sharing.