N₂O: Revisiting the best Nuclear Investment Vehicle

Edition #2 of Nuclear Newsletter by Olshansky (N₂O): What is the best ETF to invest in if you're bullish on nuclear and uranium?

tl;dr If you’re invested in URA because of Uranium, consider diversifying that position into other ETFs or fully moving it over to NUKZ to broaden your nuclear exposure. This is not financial advice.

Special thanks to ChatGPT, Google, Reddit and Claude for helping me research, prepare, write and edit this post.

Last May I wrote about why I'm allocating a large portion of my portfolio to Uranium with a bullish perspective on the nuclear sector at large.

Since then, nuclear R&D has been accelerating, uranium spot prices are down and capital expenditure from hyperscalers on the order of billions is committed. With explosive growth ahead, where should we invest today?

The goal of this post is to capture some of my initial thoughts as to what the best investment vehicle is to do so. I won’t delve into the question of “Why Uranium” or “Why Nuclear Now”, but you can read last year’s post for more details:

What’s URA 0.00%↑ up to?

I periodically check $URA’s price and noticed it hasn’t moved much. The following captures what happened just as well as a price chart:

I didn’t really think much of it because I’m in it for the long-term. I've been keeping track of major nuclear related headlines, R&D, and capturing my learnings along the way in this X thread; try clicking on it and just start scrolling down.

But, this 60 second clip from the All-In Podcast captured my attention:

Jason: “You went with your uranium ETF, not Uranus, uranium ETF. And URA was down 1% in 2024.”

Friedberg: “I know. Sideways. You know what? I looked at the components of that ETF last week when we were preparing for this. It has absolute junk in it. It was not the right way to trade uranium.”

I decided to take it as an opportunity to look into the $URA ETF and re-evaluate if there’s a better investment vehicle for the same thesis. After all, having the right thesis doesn’t matter if you’re buying the wrong thing, or if you’re buying the right thing at the wrong price.

As a quick reminder, below are the three ETFs I evaluated last year. As of 02/2025, their approximate year-over-year (YOY) returns are:

$URA : -3%

$URNM: -25%

$NLR: +23%

I don't plan on doing individual stock investing in this space (yet?), but felt that a bit more due diligence into nuclear ETFs is warranted.

What are the key nuclear investment verticals?

The U.S. Department of Energy has great illustrations & explanations on the Nuclear Fuel Cycle, with emphasis on decoupling the two key phases:

Front-end: Prepares uranium for use in nuclear reactors; mining, milling, conversion, enrichment, fuel fabrication, etc.

Back-end: Ensures that the used nuclear fuel is safely managed, recycled, or disposed of; fuel storage, recycling, and waste disposal.

However, since this is my blog, I figured I could categorize things in a way that make more sense to me, in a way that helps me build a mental model for how I want to invest and diversify.

After a bit of back & forth with ChatGPT, here are the 5 key themes we can break things into:

1. Uranium Supply Chain

2. Reactor & Plant Development

3. Fuel Cycle & Utility Operations

4. Advanced Nuclear Technology & R&D

5. Supporting Infrastructure & Emerging Applications

Based on my past research in the oil industry, I prefer the Upstream, Midstream, Downstream approach to separation of concerns rather than “front-end” and “back-end”.

Here’s where I ultimately landed to frame the 5 different investable verticals:

What this exercise made me realize is that there’s a difference between investing in Uranium and investing in Nuclear. The two are obviously closely correlated, but there’s an opportunity to diversity more broadly.

So, which ETFs should I consider investing in?

Now comes the fun part, comparing ETFs!

Here is an opinionated list of the 5 ETFs (plus a trust) that I narrowed down my research to:

URA: Established $3.3B AUM fund focused on uranium mining companies that is overweight Canada and Cameco Corp.

URNM: Established $1.4B AUM fund on uranium mining, exploration and production companies that is overweight Cameco and Kazatomprom.

NLR: Established $1.14B AUM fund with broader coverage into nuclear related activities and more evenly diversified.

NUKZ: A new $226M AUM fund with a broad nuclear thesis, a focus on American national security and has outperformed others in the past year.

HURA: Mature but small $93 AUM fund that focuses Canada and is overweight that is overweight Cameco and Kazatomprom.

SRUUF: This is a $4.6B trust (not an ETF) that tracks the raw spot price of Uranium. I don’t include it in the charts below, but called it out because the raw price of the commodity does have downstream impact on the value of everything else.

If you want more than just the 🚦 colored numbers, take a few minutes to check this table.

But, which ETF is *the best*?

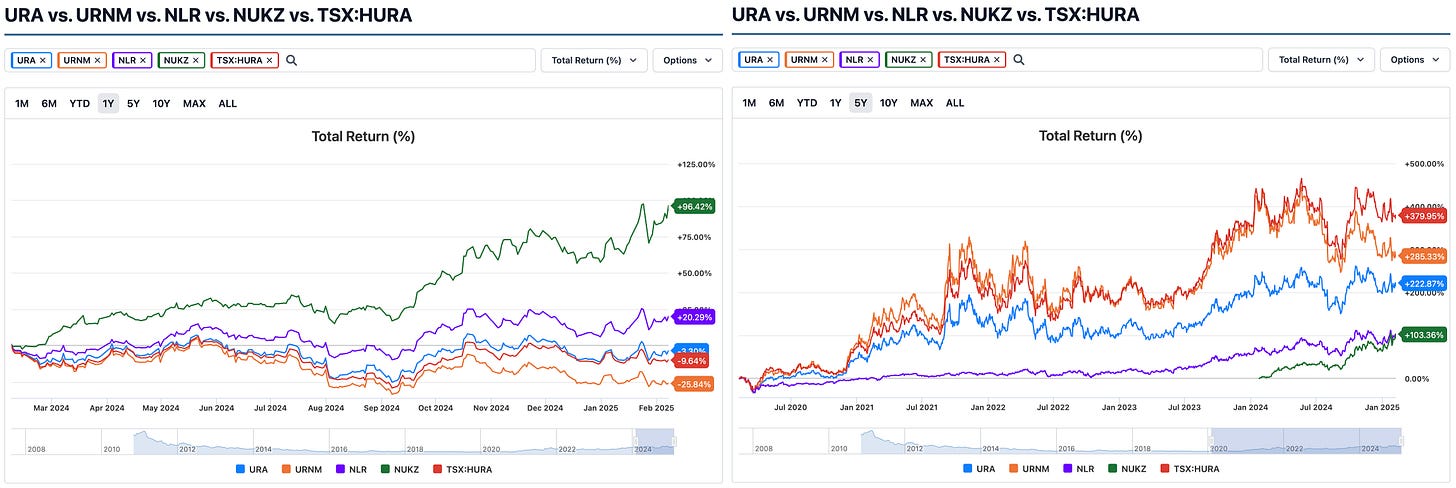

The chart below shows a comparison of the Total Return (%) of the 5 ETFs mentioned, comparing 1 year on the left vs 5 years on the right.

Looking solely at the price charts, here are my high-level observations:

NUKZ is the new cool kid on the playground outperforming everyone else in the last year. But, as we all know, “past performance is not indicative of future results”, and their prospectus even calls out the fact that they don’t have a long track history.

URNM and NLR are leading the pact with a longer track history.

URA is the least exciting (most stable) choice when it comes to balancing short-term and long-term gains or losses.

I also decided to compare the 1 year (left) and 5 year (right) returns of the 5 most common individual stock holdings that the ETFs overlap on.

Looking solely at the price charts, here are my high-level observations:

The last 5 years have been strong for everyone.

In the last year, as Uranium prices moved horizontally, so did most of the companies.

OKLO is up 450% over the last year, outperforming everyone.

Next Steps?

I’ll pause here because there’s A LOT more detail than I can dive into.

For now, I think it’s enough information to make a decision that some ETF diversification is warranted if you want more broad exposure to the up, mid and downstream parts of the Nuclear ETF rather than just Uranium.

In terms of next steps, here’s what I plan to do when time permits (or when I choose to prioritize it):

Continue rebalancing ETF diversification appropriately.

Keep up with everything going on; you can follow my living X thread.

Write up individual profiles for some of the most interesting participants. For example, this interview with the new CEO of Rolls-Royce has piqued my interest on their SMR strategy.

Consider investments in individual companies. I did some research into the financials & fundamentals of some of these, but it’s too much content for this post.

N₂O is Nitrous Oxide, commonly known as laughing gas, so none of this should be taken as investment advice.

Great breakdown! I recently did a deep dive into uranium ETFs and found that most don’t properly diversify or give enough weight to key suppliers and producers, which I think are the backbone of the ecosystem. Even when these companies are included, their allocations are often too small to capture meaningful upside.

So I put together my own ETF-style bundle with a mix of mining (CCJ), fuel enrichment (LEU), reactor development (SMR, OKLO), nuclear infrastructure (BWXT), and power generation (CEG, VST). This way, there’s exposure to the full nuclear value chain, not just one piece of the puzzle.